About us

COPA supports the decision making process at organizations via the analysis, design and application of operations research (OR) and statistical computer-based techniques. Our purpose is to contribute to the scientific and technological development of Colombia, becoming a leading group in R&D.

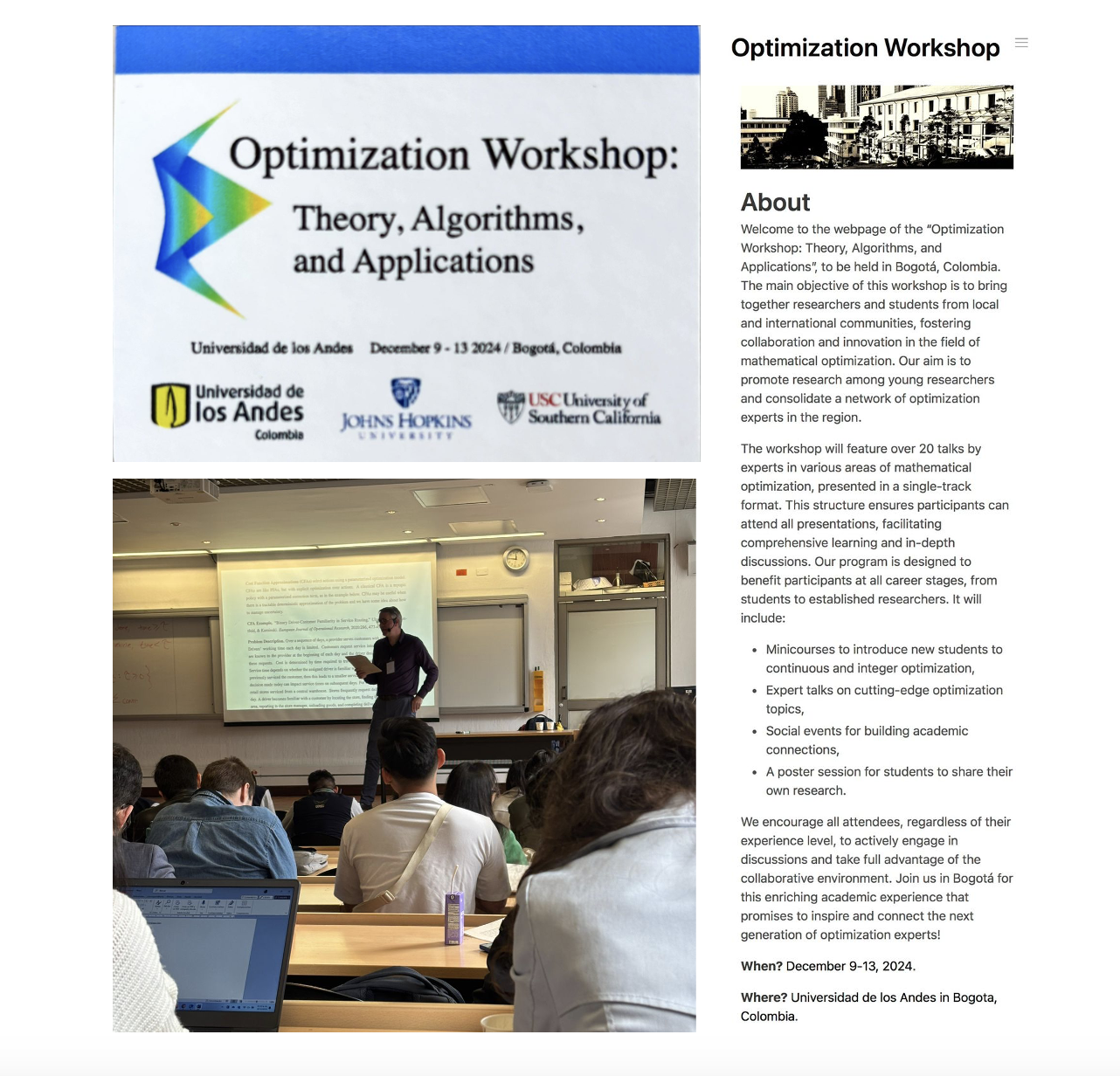

News

Login Form Site

*You must be logged into X (Twitter) in your browser to see this content.

Do you want to work with COPA?

Students

Undergraduate level

As undergraduate student you can join our research group by working with our professors, instructors or doctoral students.

Master level

You can apply to the Industrial Engineering Master program at Uniandes. Check our faculty.

Do you enjoy teaching? Funding may be available for you.

Faculty

Do you want to do joint research with UniAndes?

Check our faculty

Do you want to boost your career?

You can check funding opportunities at:

Colciencias

External

Do you have a problem we can solve?

We can research together. You can contact us or reach one of our faculty.